Registering for Self Assessment

What you'll need to register

Your Living Portal

An SA401 form

Your National Insurance Number

Step by step guide

To register for Self Assessment because you've joined a partnership (in your case, it's the Limited Liability Partnership through which you bought your home), please complete the SA401 form linked above. The following steps in this guide will take you through each stage of the SA401.

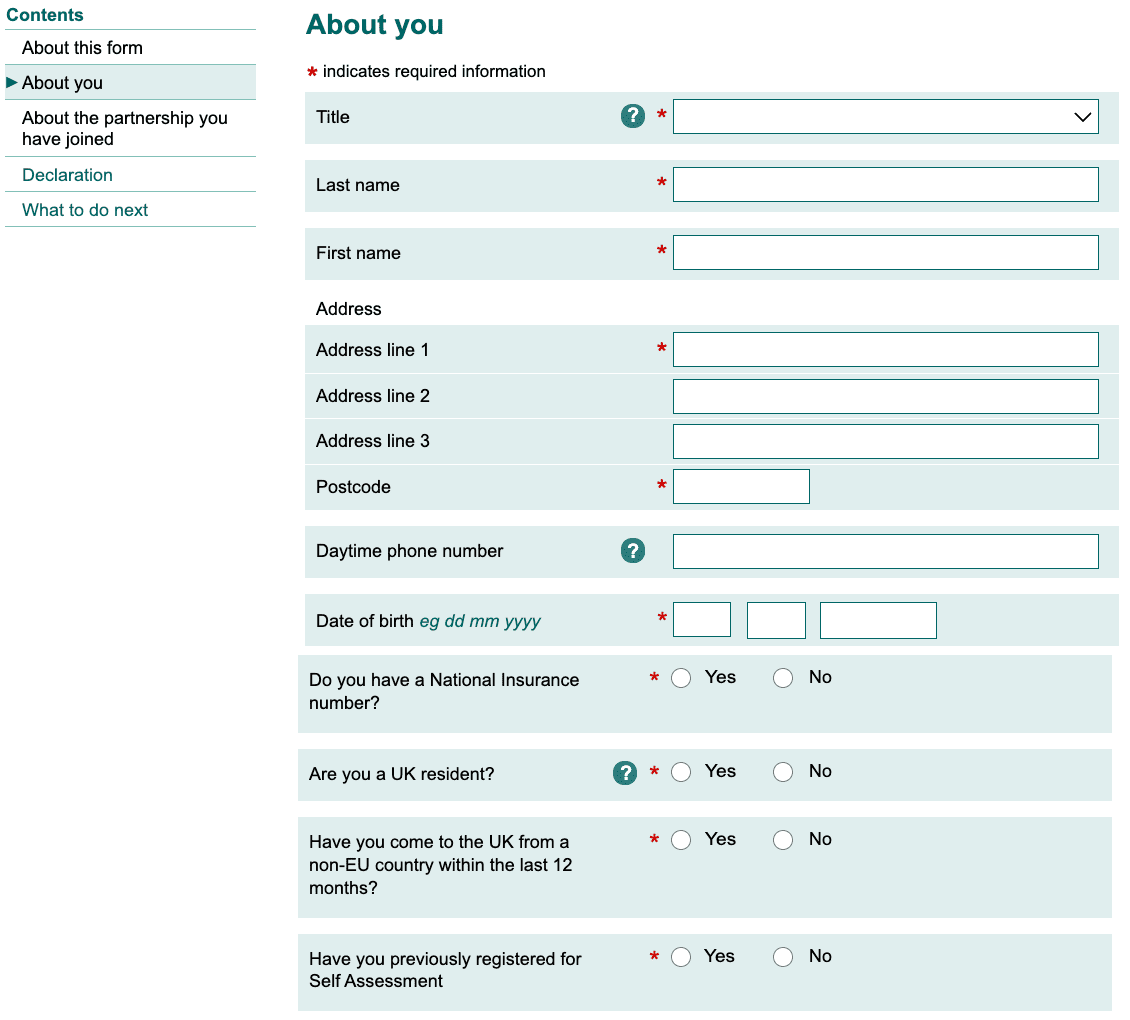

About you

The following questions in the SA401 form do not require any information specific to your LLP:

- Your title, Last Name, and First Name

- Your address

- Your daytime phone number

- Your date of birth

- Do you have a National Insurance number?

- If you select ‘yes’ to the above you will then need to enter your NI number

- Are you a UK resident?

- Have you come to the UK from a non-EU country within the last 12 months?

- Have you previously registered for Self Assessment?

- If you select ‘yes’ to the above you will need to enter your existing Self Assessment Unique Taxpayer Reference (UTR)

About you (continued)

The following questions require information specific to your LLP:

Are you the nominated partner for the partnership you are joining?

- Answer: No

When did your self employment begin?

- Answer: This is the date at the top of your signed Partnership Agreement. You can find your Partnership Agreement in your Living Portal.

About the partnership you have joined

The following questions require information specific to your LLP:

Name of partnership

- Answer: You will find this in your Living Portal.

Address of partnership

- Answer: 9 Appold Street, London, EC2A 2AP

What is the nature of the business being carried out?

- Answer: Rental business

When did you join the partnership?

- Answer: This is the date at the top of your signed Partnership Agreement. You can download your Partnership Agreement from your Living Portal.

Has a Unique Taxpayer Reference (UTR) already been allocated?

- Answer: Yes (this is referring to the Partnerships Unique Taxpayer Reference, not the one you are registering for now)

Partnership Self Assessment Unique Taxpayer Reference (UTR)

- Answer: You will find this in your Living Portal.

Are you entitled to a share of the profits, losses and other income from the partnership?

- Answer: Yes (e.g if you were to sell the property and it had increased in value since you purchased it)

Are you a Sleeping or non-active Limited Partner?

- Answer: No

Is the partnership engaged in sharefishing?

- Answer: No

Declaration

You will need to insert your full name and the date you completed the form.

What to do now you've completed the SA401

Click ‘Preview’ to view your completed form. You then need to print it, sign the Declaration page, and post the form to:

HM Revenue and Customs

NIC&EO

BX9 1AN

Once HMRC has processed your application, they'll supply you with a Unique Tax Reference (UTR) number. You need to upload this to your Living portal as soon as possible.

Upload your UTR